Did I hear that correctly?

With all the doom and gloom in the papers about the inheritance the Conservatives have left Labour, the Autumn Budget uncertainty, alarming national debt levels and a recent sharp drop in consumer confidence, you’d be forgiven for missing the fact that the British Pound, versus the US Dollar, is trading at its highest in two and a half years!

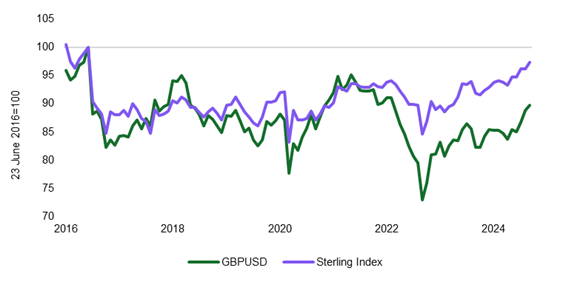

The chart below, produced by Simon French at Panmure Liberum also shows the Sterling Index (which measures the British Pound against the currencies of major trading partners) is at its highest since 2016 – with all the doom and gloom, it certainly doesn’t feel like it!

Trash-talking the UK economy has been a surprising feature of the current administration in power and whilst this may seem like easy political points to score for Labour, it does have its limits. For instance, the latest GfK survey of UK consumer confidence revealed sharp drops in predictions for personal finances and for the general economy. Many economists attributed the fall to the forthcoming Autumn Budget, in anticipation of further cuts on spending and a rise in taxation to stave off ‘economic ruin’! It seems that government is intent on replacing the good news of economic recovery, falling inflation and the prospect of lower interest rates with yet more doom and gloom.

Reasons for optimism

However, at the risk of sounding too optimistic, we believe there are sound reasons to remain positive on the UK economy and UK equities:

First and foremost, a rising British Pound makes it more difficult for UK investors to make returns on investments in US stock markets. Some strategists have been forecasting a further 10% rise in the S&P 500 which would take the headline US index close to 6,300 points. However, strong technical support behind the British Pound may take our currency much higher – some analysts have been calling for a level of 1.43 (US Dollar vs the Pound), which is a further 7% upside. A move of this magnitude would detract from the majority of the returns a UK investor would make on US investments in this example.

A stronger currency facilitates a stronger domestic economy which will benefit the UK, as the cost of imports fall, meaning inflation should continue to head on a downward trajectory enabling the Bank of England to continue normalising rates. This should provide an economic boost. A particular beneficiary of a stronger domestic economy would be UK companies that derive much of their revenue from the UK – commonly found in the market’s mid-cap and small-cap market segments.

The recent messaging from the UK government is also likely to change post the Autumn Budget to one of optimism – stability in public finances with further investment into the UK. The fact that the British Pound is at a two and a half year high against the dollar does mean the UK is seen favourably by international financial markets. The UK consumer is also in a broadly strong position – wages are growing faster than inflation, regional business activity surveys have been broadly strong and both households have very strong financial positions.

Not only are prospects for UK equities looking brighter, UK equities also tend to be less volatile compared with global equities markets. Should markets fall, having exposure to UK equities should provide diversification benefits and reduce volatility.

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.