The Importance of Maintaining Balance: Part 2!

In April 2024, I wrote a Taking Stock called ‘Mind your Balance’ – a reference to the ‘skew’ towards the US in global equity portfolios.

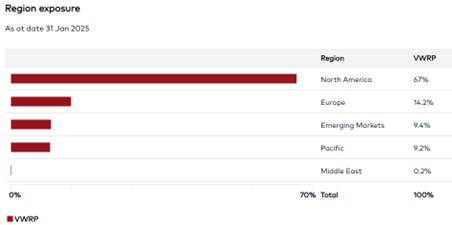

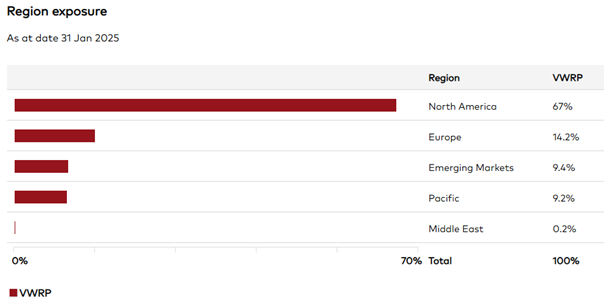

By way of an example, one of the most popular Exchange Traded low-cost tracker funds bought by UK investors is the Vanguard All World UCITS ETF. The fund is a veritable giant with £18.3bn in assets. When investing in this, an investor might be both lured and reassured by the fact that this is a low cost ‘global’ fund.

Yet as of January 2025, 67% of this fund was invested in North American equities, which is a very high concentration of equities in a ‘global’ portfolio skewed to just one, single country.

Source: Vanguard All World UCITS ETF website fact sheet: 31 January 2025

Stock markets in the UK, Germany, France, Hong Kong and Australia are all in positive territory so far in 2025. So too for Copper, Gold and some other industrial and agricultural commodities.

Meanwhile, the Vanguard tracker’s share price has fallen by 0.33% so far in 2025.

The dangers of US dominance

US dominance of global stocks markets has been so long running as to feel permanent – but this can create dangerous investor biases – such as ‘confirmation bias (e.g. the only place to invest is in the US) and recency bias (i.e. investment decisions based on only recent performance).

The US equity market has therefore continued to soak up global savings, helped in a large part by tracker funds who simply allocate more and more investor money to the US without a second thought. Meanwhile, stock markets in Europe, Asia and Emerging Markets suffer from this allocation bias.

Will global stock market leadership change?

At Raymond James, Richmond, we continue to believe that times are changing and an over-reliance on the US stock markets may harm longer term performance. When creating client portfolios at Raymond James, Richmond, we always think in terms of risk and reward – and we think some of the points below presents both risks and opportunities:

- We think President Trump is pursuing a more ‘Reagan-style’ policy implementation in the first two years of his Presidency before the mid-terms. We believe President Trump has learnt from 2016-2018, where too much of this time was spent touring the world and wooing global leaders. We think the Trump team is much more focused on policy delivery, even if this comes at the expense of falling markets. Trump himself stated that sweeping tariffs on Mexico, Canada and China may cause short term pain for Americans. Treasury Secretary has also said US inflation may see a ‘one-time slight increase’ as a result of tariffs. Whilst economic conditions were different, Reagan oversaw a US stock market that slid over much of his first term, falling by as much as 22%. President Trump and his team may view weaker markets as a price worth paying in a nod to those who elected him.

- Chinese AI model DeepSeek made headlines when newswires caught on to the fact it had been built at a fraction of the price of similar models in the US. It had been long-thought that building advanced AI models required billions of dollars of investment (using only the most advanced AI semiconductors chips) and immense amounts of power consumption. Microsoft just signed a deal to recommission and purchase power from Three Mile nuclear plant to feed the required power consumption of AI model training. But now investors are asking if that is necessary? What if AI could be advanced at a fraction of the assumed cost? In what could be seen as a warning shot to US technological supremacy, it may be telling that since the DeepSeek announcement on 27th January, the MAG 7 group of leading tech companies has, in aggregate, produced negative returns.

- In recent years, the US economic performance has been underpinned by expansionary government policy (running record peacetime deficits at a time when its economy is growing above potential), US technological leadership and higher interest rates all of which has conspired to soak up international investor capital. However, this has led to large fiscal imbalances in the US – with little sign of these trends reversing. US Treasuries, which continue to be seen as the ultimate risk-free investment asset, have seen much higher volatility for a supposed ‘safe asset’ which means for investor portfolios, they may not provide the diversification properties that they once did.

These are just a few points of debate that inform our thoughts when creating client portfolios and where we think the best returns will be. Whilst past performance may still turn investor heads, we believe the tides are turning slowly and portfolios containing a balance of investments from other parts of the world is now appropriate.

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.