August is typically a quiet month for the financial markets, however, this year it has been filled with market-moving news. Our European Strategist, Jeremy Batstone-Carr, examines key economic and geopolitical events of the last few weeks.

Letter from America

Section 899 has been struck out of the US One Big Beautiful Bill legislation

Investment Strategy Quarterly – July 2025

Our latest Investment Strategy Quarterly considers the complexities of today’s markets while drawing insights from the past. This edition includes the historic and current impact of tariffs, asks if the US still holds its safe-haven appeal for investors, and examines energy costs and AI. Closer to home, we take a look at Labour’s first year in office.

Taking Stock

Money goes home!

The opening salvo of President Trump’s ‘Make America Great Again’ policy initially caused financial markets to drop sharply as the true ramifications of the tariff policy became clear.

The merry, merry month of May

Roses and thorns

Taking Stock

I have a Cunning Plan!

…..which was often a phrase emanating from the hapless crew of Blackadder! It may sound bizarre, but could Donald Trump and the Republican Administration actually have a ‘cunning tariff plan’?

Investment Strategy Quarterly – April 2025

The second Investment Strategy Quarterly of 2025 takes the lid off some of the big themes in global investments at the moment, including the Trump effect across tariffs, deregulation, deportations and more, as well as options for UK market resilience in the face of challenging times. We also take a look at potential strategies for Europe and the case for industrial metals.

Read all this and more in Investment Strategy Quarterly: Markets on the Clock.

Spring Statement: What does it mean for your finances?

Sledgehammer

Taking Stock

The Importance of Maintaining Balance: Part 2!

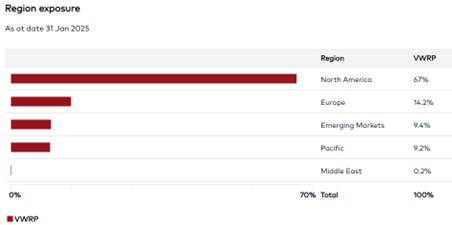

In April 2024, I wrote a Taking Stock called ‘Mind your Balance’ – a reference to the ‘skew’ towards the US in global equity portfolios.

Taking Stock

Raymond James, Richmond visits The Stoop: Harlequins 33 London Scottish 14

Following on from last September, London Scottish returned to The Stoop to face Harlequins in the 4th round of the Prem Cup.

Twin Peaks

Jeremy Batstone-Carr, Raymond James European Strategist, takes a deep dive into some of last month’s destabilizing activities including the potential ramifications of the new US administration’s campaign promises and the recent upset in the technology sector generated by China’s norm-busting AI model, DeepSeek.

Taking Stock

Raymond James, Richmond – Winter Wellness Fair

Last weekend, over 20 local small businesses around Sheen & Richmond attended the Winter Wellness Fair at the Hare & Hounds, East Sheen.Continue reading

Taking Stock

Raymond James, Richmond wishes all our clients a Merry Christmas!

Will Syria trouble markets?

“Seismic”

Our European Strategist, Jeremy Batstone-Carr considers the potentially seismic effect of the US election result on global markets, and China in particular, including some possible effects of the much-touted trade tariffs that have been promised for the coming year. And as the effects of the UK Budget become clearer, what is the potential for domestic inflation?

Silver Blaze

With the long-awaited UK Budget and the US election now upon us, Raymond James’ European Strategist, Jeremy Batstone-Carr, considers the potential effects of tax rises and increased public investment (as well as an increase in borrowing), along with some thoughts on the direction of the markets post-election.

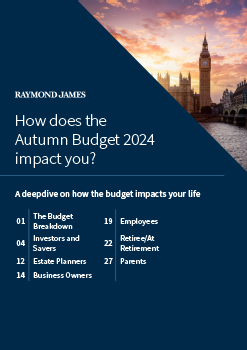

Autumn Budget Newsletter 2024

Investment Strategy Quarterly – October 2024

Our latest Investment Strategy Quarterly gives you informed insights on what we might expect from the recent change in UK government, options to consider in the run-up to the US election, the cost of tariffs and the reliability of the inverted yield curve.

Read all this and more in Investment Strategy Quarterly: The Great American Road Trip.

Taking Stock

Did I hear that correctly?

With all the doom and gloom in the papers about the inheritance the Conservatives have left Labour, the Autumn Budget uncertainty, alarming national debt levels and a recent sharp drop in consumer confidence, you’d be forgiven for missing the fact that the British Pound, versus the US Dollar, is trading at its highest in two and a half years!

Taking Stock

Raymond James, Richmond cycles from London to Amsterdam!

Last weekend, I took part in a charity cycle ride from London to Amsterdam, to raise money for Thomson House School, based in South-West London.

Taking Stock

Raymond James, Richmond visits The Stoop: Harlequins 35 London Scottish 0

Last weekend, the London Scottish Championship team visited The Stoop, home of the great Harlequins Premiership Rugby team, in a pre-season friendly that was sure to provide a fantastic spectacle! Raymond James, Richmond was very fortunate, courtesy of Charles Stanley, to have secured a box for the match – and Raymond James, Richmond clients were treated to an afternoon of French rosé, pizza and snacks. We were visited in our box by Josh Bellamy and Ben Waghorn, both Senior Academy players at Harlequins, and who helped England to victory over France in the U20 World cup this summer – an amazing achievement and two very fine, articulate young gentlemen sure to go far in the game!Continue reading

Taking stock

Raymond James, Richmond visits the US!

For those who don’t know, my wife is American and each summer we and the kids spend time in North Carolina in the US, visiting family. Also, for those who don’t know, Raymond James is predominantly a US company, founded in 1962 and a public company listed in the US since 1983. UK operations only commenced in 2001.