Welcome to Raymond James Richmond!

Raymond James Richmond opened its doors for business on 1st October 2023, offering bespoke portfolio investment management services and a very personal relationship to local residents and beyond. Our clients are placed at the heart of everything Raymond James, Richmond does.

Periodically, certain aspects of the global financial markets are assessed and potential consequences are analysed for investors. The aim is to help investors understand how Raymond James, Richmond build portfolios for clients. This month, we take a look at whether investors are aware of the risks in their portfolios, in the context of exposure to Large Cap US stocks.

How much risk am I taking?

Of course, all investors aspire to achieving the best return with minimum risks. But that is a gift the financial markets do not give easily! Investors always need to assess the risk they are prepared to take and then stick through periods of both downs and ups in markets to achieve returns.

There is one interesting conundrum that investors face today:

- Since the Great Financial Crisis, the US equity market has grown to nearly 70% of the global equity market from just 46% in 2013. It has grown so large, that when you buy a ‘global’ fund, it is likely a good chunk of your exposure will be in US equities.

- Since 2010, US equity markets have seen very strong performance compared to global peers, increasingly driven by largest, technology-orientated companies in the index which has caused investors to commit more money to US markets.

You can see why, with US equities being such a dominant force in the global investment world, for active fund managers to avoid investing in US equities, means to risk investment underperformance – so called ‘career- risk’.

However, particularly since 2020, the drivers of the US equity markets have been increasingly confined to the very largest companies. The COVID pandemic accelerated many trends, such as e-commerce and online shopping, communication via social media and working from home – all trends which many of these largest companies benefit from.

Much publicity has been made of the largest companies. Investors have called them a variety of anacronyms to try and group them together – originally, they were called FANG stocks, then FAANG stocks, then FAANG+ stocks, then MAGMAN stocks and most recently they have been given the term ‘The Magnificent Seven’, which are: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

After poor performance in 2022, last year was a particularly strong year for the US S&P 500 equity market – it was up around 23%, but most of that return – 70% – came from The Magnificent Seven.

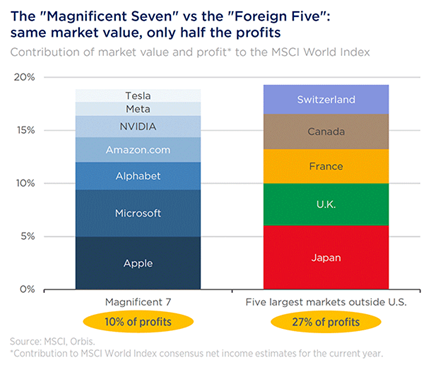

And just to give an idea of the influence of these seven companies, the chart below from Orbis Investment Management, the contribution by size and profit to the MSCI World Index. To quote Oribis:

Today, the Magnificent Seven stocks command as much market value as the “Foreign Five”, the largest developed stockmarkets outside the US by market value, yet the Seven contribute less than half the profits of those stockmarkets.

Orbis is highlighting the point that these large companies are as influential by size as the stock markets of Switzerland, Canada, France, the UK and Japan. But the cautionary tale is that they do not produce a commensurate level of profits.

Another investment house, Neuberger Berman, notes that this group of companies are less dependent on strong economic growth – they are carving out their own fortunes as the world turns to being online. These companies are very resilient with strong financial metrics:

..The Mag 7 may prove more cyclical than investors seem to expect. These giants are often considered defensive businesses given that their products drive the relentless modernization of society, and that they also boast strong balance sheets and relatively high, stable profit margins. Indeed, over the last three years, the Mag 7’s earnings beta to nominal GDP has been 30% lower than the rest of the S&P 500; however, the price beta of these stocks—at 1.4—was 50% higher than the rest of the S&P 500.

As Neuberger Berman notes, when markets turn volatile, the Beta (volatility) of this group of stocks is considerably more than the broader S&P 500. During 2022, all of The Magnificent Seven companies fell by at least 30%, with four of them falling at least 60% at one point. The S&P 500 index fell at its worst point by 26%.

Finally, a study in 2017 by Kathleen Kahle of the University of Arizona and Rene Stulz of Ohio State found that the percentage of corporate earnings accounted for the by the top 100 firms in the US doubled from 48.5% in 1975 to 84.2% in 2015 – meaning that thousands of companies in the US are competing over just 15.8% of remaining corporate earnings!! This again underscores the dominance of large cap companies in the US and the relative dearth of commensurate investment opportunities in the remaining public equity markets. Investor money continues to therefore pour into the shares of the top 100 companies, providing even more fuel for their share prices.

Observations:

- The Magnificent Seven as a group are unfathomably huge – but the profits they produce are not necessarily commensurate with their size

- They are the masters of their own destiny and do not depend on economic growth, but when US markets turn volatile, their shares prices are even more volatile

- The top 100 companies in the US produce the majority of the publicly-derived corporate earnings, meaning that by default more money flows to these top 100 companies.

So what does this all mean for investors?

Investors will likely have seen the strong performance of US equity markets, and in particular, The Magnificent Seven, over the past decade. Understandably it would feel natural to gravitate to these markets and in particular, The Magnificent Seven shares.

However, the warning signs are there – investors are placing a high premium on expectations of these companies continuing to deliver growth; their share prices can be 50% more volatile than the wider market and in general US markets exhibit characteristics of more money chasing fewer investment opportunities.

It should be made clear that this is not a prediction that US equities, or The Magnificent Seven will underperform – Goldman Sachs expects the Magnificent Seven to grow at a compound annual growth rate of 11% compared to a 3% rate for the rest of the S&P 500. Therefore, a premium valuation is no doubt warranted to these companies.

There is also good reason to expect a premium on US shares to continue – the US can be viewed as more insulated from global turmoil, whether that be conflict or unpredictable political regimes. Large government fiscal deficits in the US look set to keep growth positive and the US economy has been relatively insulated so far from interest rate hikes – if anything, economic growth is now beginning to accelerate.

However, Raymond James, Richmond focuses as much on the risks as the reward. For example, there may be other regions, markets and sectors and asset classes of the world where similar returns to US equity markets can be made without taking as much risk from a valuation perspective. This should be of benefit for investor portfolios and reduce potential volatility by diversifying portfolios. What areas are being looked at? These will be explored in forthcoming issues of Taking Stock!

Thank you to all investors who have supported the journey of Raymond James, Richmond so far!

Risk warning: With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. Past performance is not a reliable indicator of future results. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.